How I Turned Yoga Classes Into a Smarter Investment—And You Can Too

What if your weekly yoga class could do more than just calm your mind—what if it actually helped grow your wealth? I used to see yoga as just an expense, until I realized the hidden financial patterns in how I paid for it. By shifting my mindset and applying simple, practical methods, I turned a routine cost into a gateway for smarter money habits. This is the real story of how a wellness habit became a financial win—no hype, just what actually worked. It didn’t require a salary increase or drastic budget cuts. Instead, it started with asking one question: am I getting real value from this? That small shift in thinking opened the door to better spending decisions, improved financial awareness, and eventually, a more intentional approach to building wealth—one mindful choice at a time.

The Hidden Cost of Wellness: Why Yoga Classes Drain More Than Your Wallet

Wellness spending often feels different from other expenses. Unlike dining out or retail shopping, activities like yoga, meditation, or fitness classes carry a sense of virtue. They’re seen as investments in health, not indulgences. But while the physical and emotional benefits are real, the financial impact is often underestimated. What begins as a modest commitment—a $20 drop-in class or a $120 monthly studio membership—can quietly accumulate into a significant portion of a household budget, especially when frequency increases or multiple family members join in. The danger isn’t in practicing yoga; it’s in treating wellness spending as immune to financial scrutiny.

Many women in their 30s to 50s, balancing family responsibilities and personal well-being, turn to yoga as a way to manage stress and maintain physical health. It’s a reasonable and often necessary habit. Yet, the emotional appeal of self-care can cloud judgment about cost-effectiveness. For instance, purchasing a 20-class package because it “feels like a good deal” only makes financial sense if all 20 classes are actually used. Behavioral studies show that people consistently overestimate their future behavior—believing they’ll attend three times a week when, in reality, life commitments reduce that to once every ten days. This gap between intention and action turns well-meaning spending into a financial leak.

Another overlooked factor is the psychological comfort of routine. Paying for something regularly—like a monthly membership—creates a sense of structure and commitment. But this comfort comes at a price. When payments become automatic, they also become invisible. The brain stops registering the cost, especially when the service is tied to personal improvement. This cognitive bias allows unused memberships to linger for months, draining funds that could be better allocated elsewhere. The result? A habit intended to reduce stress ends up contributing to financial strain, even if the individual isn’t consciously aware of it.

Recognizing this pattern was the first step in my financial shift. I began tracking not just how much I spent on yoga, but how often I actually attended. What I discovered was sobering: over six months, I had paid for 48 classes through a premium unlimited plan but only attended 19. That meant I was spending nearly $25 per attended class when I could have paid $20 per drop-in and come out ahead. The difference wasn’t trivial—it amounted to over $600 in wasted spending. That realization wasn’t about guilt; it was about awareness. Once I saw the data, I could make better choices. And that awareness became the foundation for smarter financial behavior in other areas of my life.

From Expense to Asset: Reframing Yoga as a Financial Opportunity

Changing how I viewed yoga didn’t mean giving it up—it meant redefining its role in my financial life. Instead of seeing each payment as a necessary cost, I began to treat it as a case study in spending behavior. This mental shift transformed yoga from a passive expense into an active tool for financial learning. The key was simple: every dollar spent carries information. When tracked and analyzed, even small, routine expenditures reveal patterns that can be optimized. By treating my wellness spending as data, I uncovered habits that extended far beyond the studio walls.

One of the most revealing insights was the concept of subscription fatigue. Like many people, I had multiple recurring payments: streaming services, meal kits, fitness apps, and of course, my yoga membership. Individually, each felt manageable—$10 here, $15 there. But together, they formed a steady outflow of money, most of which I rarely thought about. Yoga became the entry point for auditing this system. Once I canceled my underused studio plan, I applied the same logic to other subscriptions. Within two months, I eliminated five recurring charges totaling $83 per month. That’s nearly $1,000 a year—money that could go toward debt reduction, savings, or investment.

Another lesson came from payment timing. I noticed that I was more likely to use classes when I paid per session rather than when I had unlimited access. This aligned with research in behavioral economics: people tend to value resources more when they are scarce. Unlimited plans, while marketed as cost-saving, often lead to lower utilization because the perceived cost per use drops to zero. In contrast, paying per class created a sense of accountability. Each visit felt intentional, not automatic. This small psychological nudge improved my consistency and made the experience more valuable, both personally and financially.

By reframing yoga as a financial experiment, I also began to see parallels in other areas of spending. Grocery shopping, transportation, even household maintenance—each carried similar opportunities for optimization. The discipline of tracking usage, questioning necessity, and aligning payment models with actual behavior became a repeatable process. What started as a single habit audit evolved into a broader financial mindfulness practice. Over time, this approach didn’t just save money—it built confidence in decision-making. I no longer felt like money was slipping through my fingers. Instead, I felt in control, making choices based on evidence, not emotion.

The Subscription Trap: Why Studio Memberships Can Backfire

Monthly yoga memberships are often sold as the smart choice—unlimited access for a flat fee, promising both convenience and savings. Studios market them as flexible, commitment-free ways to prioritize well-being. But in reality, these plans can be financial traps, especially for individuals with unpredictable schedules. The core issue lies in the mismatch between payment structure and actual usage. When you pay for unlimited access, you’re betting on your future behavior. And more often than not, that bet doesn’t pay off.

The psychology behind this trap is well-documented. It’s called the sunk cost fallacy—the tendency to continue an endeavor once an investment has been made, even when continuing no longer makes sense. For example, someone who pays $120 for unlimited classes in January may feel obligated to attend frequently throughout the month, even when tired, busy, or unwell. But if they only go four times, they’re paying $30 per class. Meanwhile, a drop-in rate of $20 would have been cheaper. Worse, if they go only twice, the effective cost doubles to $60 per class—more than double the walk-in price. The membership doesn’t save money; it increases the financial burden per use.

Auto-renewals and long-term contracts amplify this problem. Many studios enroll members in recurring billing by default, with cancellation requiring advance notice or phone calls. This creates friction, making it easier to keep paying than to opt out. Over time, unused memberships accumulate—months of payments for services never accessed. I knew a woman who realized, after reviewing her bank statements, that she had been paying for a yoga membership for 11 months straight despite attending only three classes. She had forgotten to cancel after a vacation and assumed she’d return to regular practice. Instead, she lost over $1,300—a sum that could have covered a family weekend getaway or a significant portion of a car repair.

Another red flag is the pressure to “get your money’s worth.” Unlimited plans encourage overuse, not efficiency. People may attend classes they don’t enjoy or don’t need just to justify the cost. This leads to burnout, reduced satisfaction, and eventually, disengagement. The emotional toll of forcing oneself to participate diminishes the very benefits wellness is meant to provide. A healthier financial approach is to align spending with realistic habits, not aspirational ones. That means choosing payment models based on actual attendance, not hoped-for frequency. For most people, especially those with fluctuating schedules, pay-per-class or limited packages offer better value and greater flexibility.

Pay-Per-Class vs. Bundles: Finding the Model That Fits Your Real Life

When it comes to pricing, not all yoga plans are created equal. Studios typically offer three main options: drop-in rates, bundled class packages, and unlimited monthly memberships. Each has its place, but only one is likely to be the most cost-effective for your actual lifestyle. The challenge is determining which model aligns with your real-world behavior, not your idealized routine. This decision shouldn’t be based on emotion or marketing—it should be grounded in data.

Drop-in classes are the simplest and most transparent option. You pay only when you attend, with no long-term commitment. While the per-class cost is higher—typically between $18 and $25—it ensures that you’re only paying for value received. This model works best for individuals with irregular schedules, those new to yoga, or anyone unsure about long-term participation. It removes financial risk and promotes mindful engagement. Each visit feels intentional, not obligatory. Over time, this can lead to greater satisfaction and consistency, as attendance is driven by genuine desire, not financial pressure.

Bundled packages—such as 5, 10, or 20-class cards—offer a middle ground. They provide a modest discount (usually 10% to 20%) in exchange for prepayment. On the surface, this seems like a smart deal. But the savings only materialize if all classes are used. A 10-class pack at $180 ($18 per class) is a bargain if you attend 10 times in two months. But if you only use six, the effective cost rises to $30 per class—more than a drop-in rate. The key is tracking usage over time. One effective method is to start with a small package and monitor attendance for 45 to 60 days. If you consistently use classes at the expected rate, larger bundles may be worthwhile. If not, sticking with pay-per-class is the smarter financial move.

Unlimited monthly plans are the riskiest option for most people. They make sense only for those who attend frequently—typically four or more times per week. For the average participant, who might go once or twice a week, the math rarely works. Consider this: a $120 unlimited plan requires at least six visits per month to match the value of a $20 drop-in rate. Few people maintain that level of consistency over time. Life events, illness, travel, and seasonal changes all disrupt routines. The unlimited plan assumes stability, but real life is anything but predictable. For most women juggling work, family, and personal time, a flexible, usage-based model offers better financial protection and peace of mind.

Leveraging Community and Barter: Non-Monetary Ways to Access Yoga

Money is not the only way to access wellness. Many studios offer alternative pathways to participation that don’t involve direct payment. One of the most effective is the work-trade program, where individuals contribute time or skills in exchange for classes. Common roles include greeting students at the front desk, assisting with studio maintenance, or helping with special events. In return, participants receive full access to classes—sometimes unlimited, sometimes capped at a certain number per month. This model benefits both parties: the studio gains support, and the participant gains access without cash outlay.

For women with flexible schedules or part-time availability, work-trade can be a powerful financial tool. A few hours of service per week can eliminate hundreds of dollars in annual studio fees. More importantly, it fosters a deeper connection to the community. Instead of being a passive consumer, you become an active contributor. This shift in role enhances the overall experience, making each class feel more meaningful. It also builds soft skills—communication, reliability, teamwork—that can translate into professional growth. The value extends beyond the mat, creating ripple effects in personal and financial well-being.

Community-based barter is another underused strategy. Local wellness networks often facilitate skill exchanges—yoga teachers offering classes in return for massage therapy, nutrition coaching, or childcare. These arrangements operate on mutual benefit, not cash transactions. While informal, they can be highly effective when built on trust and clear expectations. For example, a mother who teaches piano lessons might arrange to trade two hours of instruction per month for unlimited yoga access. Both parties save money and strengthen community ties. This form of economic cooperation reflects a broader principle: your time and skills are assets. When leveraged wisely, they can reduce living expenses and increase financial flexibility.

Even without formal programs, small shifts in behavior can yield savings. Some studios offer discounts for off-peak classes, referrals, or social media engagement. Others host donation-based community classes, where participants pay what they can. These options provide access at a fraction of standard rates. The key is asking questions and being proactive. Many people assume they must pay full price, not realizing alternatives exist. By engaging with studio staff and fellow practitioners, you open doors to lower-cost pathways. This mindset—seeking value, not just paying the default rate—applies to countless areas of personal finance, from insurance to utilities to healthcare.

Redirecting Savings: Turning Yoga Budgets Into Growth Opportunities

Every dollar saved is a dollar available for better use. When I optimized my yoga spending—switching from an unlimited plan to a pay-per-class model and using work-trade opportunities—I freed up nearly $90 per month. That may not seem like much, but over a year, it totals $1,080. Instead of letting that money disappear into forgotten subscriptions or impulse purchases, I redirected it into high-impact financial goals. This is where the real transformation happened—not in cutting costs, but in reallocating resources toward long-term security.

The first step was building my emergency fund. Financial experts consistently recommend having three to six months’ worth of living expenses set aside for unexpected events. Yet, nearly 40% of adults in the U.S. say they couldn’t cover a $400 emergency. My $90 monthly savings allowed me to strengthen this safety net without straining my budget. Within a year, I added over $1,000 to my emergency savings, bringing me closer to true financial resilience. That cushion reduced anxiety and gave me confidence to make bolder financial decisions, like negotiating a better car insurance rate or skipping unnecessary repairs until I could afford quality service.

The next step was tackling high-interest debt. I had a small balance on a credit card at 19% annual interest—a silent wealth destroyer. By applying my $90 monthly surplus to that balance, I paid it off months ahead of schedule and saved over $150 in interest. That’s money that stayed in my pocket instead of going to the bank. The psychological benefit was even greater: eliminating that debt lifted a constant source of stress. It proved that small, consistent actions could produce tangible results. This success motivated me to audit other areas of spending, uncovering additional savings that I funneled into debt reduction and savings.

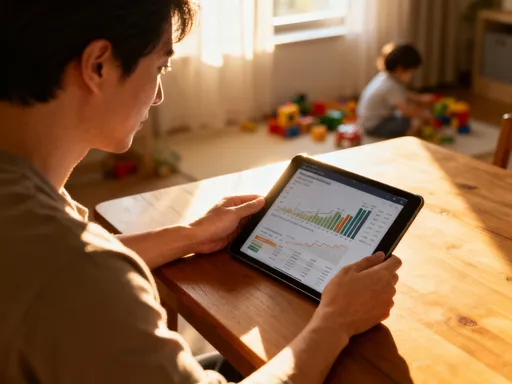

Finally, I began micro-investing. Using a low-cost, automated investment app, I set up a recurring transfer of $50 per month into a diversified index fund. The remaining $40 went toward a children’s education fund. While $50 may seem insignificant compared to larger investment goals, the power lies in consistency and compounding. Assuming a 7% annual return, that $50 per month could grow to over $8,000 in ten years and more than $25,000 in 25 years. I didn’t need a windfall or a raise to start building wealth. I simply redirected funds from an inefficient expense into a growth vehicle. The lesson was clear: financial progress doesn’t require dramatic changes—it requires consistent, intentional choices.

Building Financial Awareness Through Everyday Habits

The true value of this journey wasn’t measured in dollars saved, though those numbers mattered. It was measured in awareness—the quiet shift from passive spending to active decision-making. By applying financial discipline to a single habit, I developed skills that transferred to every area of money management. I became more attentive to billing cycles, more skeptical of marketing claims, and more confident in my ability to make smart choices. This mindset didn’t just prevent waste; it created opportunity.

Financial health, like physical health, is built through repetition. Just as regular yoga strengthens the body, regular financial reflection strengthens decision-making. Tracking spending, evaluating value, and adjusting behavior aren’t one-time tasks—they’re practices. Over time, they become second nature. I now apply the same questions to every recurring expense: Am I using this? Is it worth the cost? Is there a better way? These simple inquiries have led to better deals on internet service, reduced food waste, and smarter insurance choices. Each small win compounds, creating a foundation for long-term stability.

For women managing household budgets, the stakes are high. Every dollar counts. But financial control doesn’t come from deprivation—it comes from intention. You don’t have to give up yoga or any other meaningful habit to be financially responsible. You just need to engage with it mindfully. When you treat spending as a series of conscious choices rather than automatic transactions, you reclaim power. You stop being a passenger in your financial life and become the driver.

In the end, my yoga practice didn’t just improve my flexibility or reduce my stress. It became a mirror for my financial habits, revealing both weaknesses and strengths. It taught me that wealth isn’t built through luck or large windfalls, but through small, consistent decisions aligned with real life. You don’t need a complex strategy or a financial advisor to start. You just need to look closely at one habit, ask one question, and take one step. From there, the path to smarter money management unfolds naturally—one breath, one choice, one investment at a time.