How I Handle Accident Coverage Without Stress — A Real Risk Management Move

Accidents happen when we least expect them — I learned this the hard way after a minor car crash left me with unexpected bills. That’s when I realized having solid accident coverage isn’t just about insurance; it’s about smart risk management. I started rethinking my finances, not just for protection, but to stay in control. This is how I built a practical, no-fluff strategy that balances cost, coverage, and peace of mind — and why it might be one of the smartest financial moves you’ll ever make.

The Wake-Up Call: When Life Throws You a Curveball

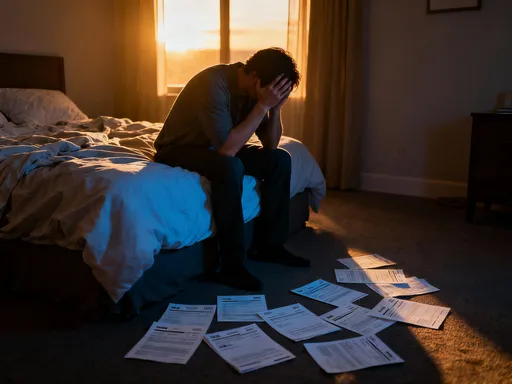

It was a Tuesday morning like any other. I was driving to drop my youngest at school, coffee in hand, listening to the local news. The traffic light turned green, I stepped on the gas — and then, in less than a second, everything changed. A car ran the red light and hit my passenger side. The impact wasn’t fatal, but it was jarring. My car was totaled, my shoulder needed physical therapy, and I missed nearly three weeks of work. I had health insurance and auto coverage, but what followed wasn’t relief — it was a flood of out-of-pocket expenses I hadn’t prepared for.

At first, I assumed my health plan would cover everything. But co-pays for imaging, specialist visits, and therapy sessions started to add up quickly. My auto insurance covered the vehicle replacement, but not the rental car I needed while waiting for repairs — and certainly not the income I lost during recovery. What I thought was a minor incident became a financial ripple effect: medical bills, temporary childcare adjustments, and even higher utility costs due to reduced mobility. The total unexpected cost? Just under $7,000 over six months.

This wasn’t a catastrophic event by societal standards, but it was life-disrupting. It exposed a gap in my financial planning that I hadn’t even known existed. I had savings, yes, but not enough to absorb this kind of unplanned expense without stress. That moment became a turning point. I realized that true financial resilience isn’t just about earning well or saving consistently — it’s about anticipating risks before they strike. Accident coverage, I learned, isn’t an add-on. It’s a core component of personal risk management, especially for those of us managing households, careers, and family responsibilities.

For many women in their 30s to 50s, financial decisions are made not just for themselves, but for entire families. The idea of being unable to work, even temporarily, carries emotional and economic weight. That crash didn’t just damage my car — it shook my confidence in my ability to protect what I’ve built. But from that discomfort came clarity: being insured isn’t the same as being protected. Real protection means understanding exactly what your policies cover — and where they fall short.

What Accident Coverage Really Means (And What It Doesn’t)

There’s a common misconception that accident coverage is the same as health insurance or auto insurance. It’s not. While those policies cover broad categories of risk, accident coverage is specifically designed to address the financial fallout from unexpected physical injuries — whether from a fall at home, a sports injury, or a traffic collision. It’s a targeted layer of protection that kicks in where other policies leave gaps. For example, while health insurance may cover your emergency room visit, it might not reimburse lost wages, transportation to therapy, or home modifications needed during recovery.

Accident insurance, when structured wisely, provides lump-sum cash benefits directly to you if you experience a qualifying injury. These payments are not tied to your medical bills — they’re yours to use as needed. That means you can pay for prescriptions not covered by your plan, hire a cleaner while you’re healing, or cover groceries if your spouse needs to take unpaid time off to help. This flexibility is what makes it uniquely valuable. Unlike health insurance, which pays providers, accident coverage pays you — giving you control when you need it most.

However, it’s critical to understand what accident coverage does not do. It won’t cover illnesses like heart attacks or strokes unless they result directly from a documented accident. It typically excludes pre-existing conditions, self-inflicted injuries, or incidents that occur during high-risk activities like skydiving or competitive sports. Most policies also have limits on payout amounts and specific definitions of what qualifies as a covered event — for instance, a broken bone may trigger a benefit, but a sprain might not. Reading the fine print is essential.

Another important distinction is between standalone accident insurance and riders attached to life or disability policies. Some employers offer accidental death and dismemberment (AD&D) as part of a benefits package, but these usually only pay out in extreme cases — such as the loss of a limb or vision — and not for temporary disabilities. A comprehensive accident plan goes beyond that, offering tiered benefits based on the severity of the injury. Understanding these differences allows you to build a strategy that’s not based on assumptions, but on actual protection.

Why Risk Management Starts Long Before the Accident

Many people treat risk management as something you do after a crisis — but that’s like installing smoke detectors after the fire. True financial safety comes from proactive planning. The foundation of effective risk management is assessing your personal exposure: Where are you most vulnerable? What would happen if you couldn’t work for a month? How would your family manage day-to-day expenses if you were injured?

For women managing households, the answer often involves more than just income. It includes caregiving responsibilities, transportation logistics, and emotional stability. A broken arm might seem minor, but if you’re the one driving kids to school, preparing meals, and managing appointments, even a short-term injury can create long-term strain. This is why risk assessment must go beyond generic advice. Your job, lifestyle, and family structure all influence your level of risk.

Consider two scenarios: A teacher who walks students across a parking lot daily faces different physical risks than an office worker who drives two hours each way. A single mother with no nearby family support has higher dependency risk than someone with a strong local network. These factors should shape your coverage, not broad marketing messages. Risk management isn’t about fear — it’s about honesty. It’s acknowledging that life is unpredictable and building a plan that reflects your reality, not an idealized version of it.

One of the most effective tools I used was a simple risk inventory. I listed all my daily activities, transportation methods, physical demands at work, and family dependencies. Then, I mapped potential injury scenarios and estimated their financial impact. This exercise wasn’t meant to scare me — it was meant to clarify. It helped me identify which risks were already covered (like auto accidents) and which were not (like a fall at home). From there, I could prioritize where additional protection made the most sense. This kind of assessment turns abstract worry into actionable insight.

Building Your Safety Net: A Step-by-Step Approach

After my accident, I didn’t rush to buy the first policy I found. Instead, I took a structured approach to rebuilding my financial safety net. The first step was auditing what I already had. I reviewed my employer-provided health insurance, disability coverage, auto policy, and any supplemental benefits. I discovered that while I had basic AD&D coverage, it only paid out in cases of death or severe dismemberment — not for the kind of injury I’d experienced.

Next, I identified gaps. The biggest one was income replacement during short-term disability. My employer offered a limited short-term disability plan, but it required a two-week waiting period and only covered 60% of my salary. That meant nearly three weeks of zero income — a gap that had already caused real hardship. I also lacked coverage for non-medical expenses like transportation, home help, or therapy co-pays. These weren’t minor costs; they were essential to my recovery and daily functioning.

With this clarity, I began researching supplemental accident insurance. I focused on plans that offered lump-sum payouts for specific injuries, with no requirement to submit medical bills. I compared policies from multiple providers, paying close attention to benefit amounts, exclusions, and waiting periods. I also looked at portability — whether the policy stayed with me if I changed jobs. After evaluating several options, I chose a plan that offered tiered benefits: a smaller payout for fractures, a higher one for hospitalization, and additional funds for rehabilitation.

The final step was layering. I didn’t rely on a single policy. Instead, I combined my new accident insurance with an enhanced short-term disability plan and a dedicated emergency fund. This multi-layered approach ensured that no single point of failure could undermine my security. It wasn’t about having the most coverage — it was about having the right coverage, tailored to my life. The total monthly cost was under $50, a small price for the peace of mind it brought.

Smart Moves That Save Money Without Sacrificing Protection

One of the biggest myths about insurance is that better protection means higher cost. That’s not always true. Through careful research, I found several ways to enhance my coverage without overspending. The first was bundling. Some insurers offer discounts when you combine accident insurance with other supplemental policies like critical illness or hospital indemnity. By bundling, I reduced my per-policy cost by nearly 15% — a meaningful saving over time.

Another strategy was choosing high-value riders. Many accident policies allow you to add optional benefits, such as child coverage, transportation reimbursement, or wellness incentives. I added a rider that provides a small annual wellness bonus for completing a health screening — a win-win that rewards prevention while lowering long-term risk. I also opted for a rider that increases benefits if the accident occurs while traveling, which made sense given my occasional work trips.

Timing was another key factor. I learned that open enrollment periods — both through my employer and private insurers — often offer better rates and fewer underwriting hurdles. By applying during these windows, I avoided medical exams and secured guaranteed issue coverage. I also reviewed my policy annually, adjusting coverage as my life changed — for example, increasing benefits after a salary raise or adding dependents.

One of the most impactful decisions was adding accidental death and dismemberment (AD&D) coverage wisely. Rather than accepting the default employer-provided amount, I purchased additional coverage at a low group rate. This ensured my family would have immediate financial support in the worst-case scenario, without straining my budget. These weren’t flashy moves — they were practical, deliberate choices that maximized value. Over five years, these strategies saved me over $1,200 in premiums while significantly improving my protection.

Beyond Insurance: How Cash Reserves and Planning Work Together

No insurance policy can cover every possible expense. That’s why I made building an emergency fund a parallel priority. I set a goal of saving six months’ worth of essential living expenses — housing, food, utilities, insurance premiums, and transportation. This fund isn’t meant for vacations or home upgrades; it’s strictly for unexpected disruptions like medical leave, car repairs, or job loss.

I automated monthly transfers to a high-yield savings account, treating it like a non-negotiable bill. Over time, this fund became a critical part of my financial resilience. When I had to take unpaid time off after my accident, I used a portion of it to cover groceries and utilities — not because I lacked insurance, but because insurance doesn’t pay for everything. The combination of cash reserves and targeted insurance created a buffer that prevented financial domino effects.

I also integrated income continuity planning. This meant understanding how long I could go without a paycheck and what alternatives existed — such as short-term disability, family support, or part-time remote work during recovery. I documented this plan and shared it with my spouse, so we were both clear on next steps if something happened. Knowledge, in this case, was as valuable as money.

Finally, I leveraged workplace benefits fully. Many employers offer free financial wellness resources, including access to financial planners, debt management tools, and educational workshops. I attended a seminar on risk management that helped me refine my approach. These resources, often overlooked, added depth to my strategy without additional cost. Insurance is powerful, but it works best when supported by liquidity, planning, and knowledge.

Making It Yours: How to Start Today Without Overwhelm

If you’re reading this and feeling behind, you’re not alone. Most people don’t think about accident coverage until they need it. The good news is, it’s never too late to start. The first step is simply reviewing your current policies. Gather your health, auto, life, and disability insurance documents. Read the summaries of benefits. Ask yourself: What happens if I break a bone? What if I need surgery? What if I can’t work for two weeks?

Next, identify gaps. Are you covered for non-medical expenses? Do you have income protection during short-term disability? Is your emergency fund sufficient? Write down your answers — this becomes your risk assessment baseline. Then, research supplemental accident insurance options. Look for plans with clear benefit structures, reasonable premiums, and portability. Talk to a licensed insurance professional if needed, but come prepared with your questions.

I used a simple checklist: Does it pay a lump sum? Are benefits tax-free? Is there a waiting period? Can I customize it with riders? Does it cover dependents? Answering these helped me narrow my choices. I didn’t make a decision overnight — I compared three options over two weeks. Taking your time is part of being smart, not slow.

Finally, start small. You don’t need to overhaul your entire financial plan in one day. Open a dedicated savings account for emergencies. Increase your coverage by $10,000. Automate one new transfer. These small actions compound over time. Risk management isn’t about perfection — it’s about progress. And the best time to begin is before life throws you another curveball.

Looking back, my accident was more than a setback — it became a financial wake-up call. What I built isn’t just a policy; it’s a mindset. Real risk management isn’t about eliminating uncertainty — it’s about preparing for it with confidence. By taking control of accident coverage the smart way, you’re not just protecting your money — you’re protecting your future peace of mind. And that’s a move worth making.