How I Turned Accident Insurance into a Tax-Smart Safety Net

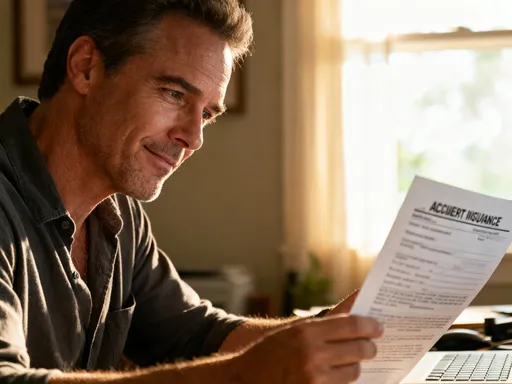

Most people see accident insurance as just a backup plan—something you pay for and hope to never use. But what if it could do more than protect your health? I discovered that with a systematic approach, this often-overlooked coverage can also support smart tax planning. It wasn’t obvious at first, but once I connected the dots, the benefits became clear. Accident insurance, when structured thoughtfully, doesn’t just cover medical bills or lost wages—it can deliver tax-free funds exactly when financial pressure mounts. This quiet advantage, hidden in plain sight, became a cornerstone of my family’s financial resilience. Let me walk you through how I turned a simple policy into a strategic part of my financial routine.

The Hidden Role of Accident Insurance in Financial Planning

Accident insurance is commonly misunderstood as a narrow form of protection—something you might consider if your job involves physical risk or if you’re an active parent managing a busy household. Yet its role extends far beyond emergency care or temporary disability. When viewed through a financial planning lens, accident insurance emerges as a disciplined tool for preserving income and maintaining stability during unexpected disruptions. Unlike traditional health insurance, which reimburses medical providers directly, accident insurance pays benefits directly to the policyholder. These payments are typically received in lump sums and are not considered taxable income by tax authorities, provided the policy is funded with after-tax dollars. This distinction is crucial. It means the money can be used freely—whether for medical co-pays, transportation to therapy, child care during recovery, or even mortgage payments—without triggering a tax liability.

What makes this especially valuable is the predictability it introduces into an unpredictable situation. A broken leg, a car accident, or a fall at home can lead to weeks of lost wages and mounting expenses. In such moments, receiving a tax-free check can ease the burden significantly. But more than that, when integrated into a broader financial strategy, accident insurance becomes part of a layered defense system. It complements disability insurance, health savings accounts, and emergency funds, filling gaps that other instruments may not cover. For example, while short-term disability might replace a portion of income after a waiting period, accident insurance can provide immediate cash upon diagnosis of a covered injury. This timeliness, combined with tax efficiency, transforms the policy from a passive cost into an active asset.

Moreover, the psychological benefit of knowing there’s a reliable, no-strings-attached fund available cannot be overstated. For families managing tight budgets or single-income households, the fear of financial collapse after an injury can be more paralyzing than the injury itself. Accident insurance reduces that anxiety by offering a clear, predefined financial response. It’s not about replacing comprehensive health coverage—it’s about adding precision to protection. By identifying specific risks and aligning coverage amounts accordingly, individuals can create a tailored safety net that works in harmony with their lifestyle and financial obligations. This strategic mindset shifts the conversation from mere risk avoidance to proactive financial empowerment.

Why Tax Planning Matters in Risk Protection

When most people think about insurance, taxes are rarely the first concern. The focus tends to be on coverage limits, deductibles, and whether a policy will pay out when needed. But what happens after the check arrives? That’s where tax planning becomes critical. Not all insurance benefits are treated equally under tax law, and misunderstanding this can lead to unexpected liabilities. For instance, employer-paid disability benefits are often taxable to the recipient, whereas benefits from individually purchased policies—when funded with after-tax premiums—are generally tax-free. This same principle applies to accident insurance. Because policyholders pay premiums with income that has already been taxed, the benefits they receive later are not subject to additional taxation.

This tax-free nature of accident insurance payouts is not a loophole—it’s a deliberate feature designed to encourage personal responsibility in risk management. The system rewards individuals who take initiative to protect themselves outside of employer-sponsored plans. When a policy pays out $10,000 for a covered injury, the full amount goes to the beneficiary. There’s no 25% reduction for income tax, no reporting requirement on Form 1099 unless specific conditions apply, and no need to adjust estimated tax payments. In contrast, if someone relies solely on a line of credit or withdraws from a retirement account to cover unexpected expenses, those actions can trigger interest costs or early withdrawal penalties—and potentially increase taxable income in a given year.

The implications are especially meaningful for self-employed individuals and small business owners, who often lack access to comprehensive group benefits. These earners typically manage their own risk protection and face higher variability in income. A sudden accident could disrupt client work, delay projects, or halt revenue streams entirely. In such cases, receiving a tax-free benefit allows them to maintain cash flow without distorting their tax profile. It also avoids the need to dip into business reserves, which might otherwise be allocated for growth or expansion. Over time, the cumulative effect of tax-efficient payouts can preserve thousands of dollars that would otherwise go toward tax obligations or debt servicing.

Tax planning in risk protection isn’t about minimizing what you owe—it’s about maximizing what you keep. By aligning insurance choices with tax-aware strategies, individuals gain greater control over their financial outcomes. This requires foresight, but the payoff is resilience. When protection is designed with both risk and tax implications in mind, it becomes more than insurance; it becomes a tool for long-term financial clarity.

Building a System: Aligning Coverage with Financial Goals

Purchasing accident insurance should not be a one-off decision based on price or convenience. To derive real value, it must be part of a coordinated financial system—one that reflects personal circumstances, income patterns, and future goals. The first step is assessing exposure. How likely is an accident given your lifestyle? Do you commute frequently? Engage in outdoor activities? Work in a physically demanding role? While no one can predict the future, understanding risk factors helps determine the appropriate level of coverage. A delivery driver may need higher limits than an office worker, just as a parent with young children may prioritize benefits that cover home care or transportation costs.

Once risk is assessed, the next step is aligning policy design with financial objectives. For example, if the goal is to protect against income disruption, a policy with a strong daily hospital indemnity or a lump-sum payout for fractures or dislocations makes sense. If the focus is on preserving emergency savings, a plan with broad definitions of covered accidents and fast claims processing is ideal. Some policies even offer recurring payments for extended recovery periods, which can mirror the function of short-term disability but with more flexibility and faster activation. The key is to treat accident insurance not as a standalone product, but as a component of a financial ecosystem that includes savings, investments, and other insurance layers.

Timing also plays a critical role. Purchasing a policy while healthy ensures eligibility and lower premiums. Waiting until after a health scare or a previous claim can result in higher costs or even denial of coverage. Similarly, reviewing and adjusting coverage during major life events—marriage, childbirth, home purchase, or career change—ensures it remains relevant. A policy bought ten years ago may no longer match current financial responsibilities. A systematic approach means treating insurance like any other financial instrument: it should be monitored, evaluated, and updated as needed.

Equally important is coordination with existing benefits. Many people assume their employer’s group plan is sufficient, but these policies often have lower limits, narrow definitions, or require long waiting periods. Relying solely on them can leave significant gaps. By layering an individual accident policy on top, individuals can close those gaps while maintaining tax advantages. This layered strategy enhances protection without redundancy, ensuring that benefits are comprehensive yet efficient. When coverage is intentional and well-integrated, it stops being an expense and starts functioning as a strategic asset.

Real Scenarios: Where Protection Meets Tax Efficiency

The true value of accident insurance becomes visible not in theory, but in real-life situations. Consider Sarah, a freelance graphic designer working from home. She has no employer-sponsored disability plan and relies on steady project income to cover her mortgage and childcare expenses. One winter morning, she slips on ice while taking out the trash and fractures her wrist. She’s unable to work for six weeks. Her health insurance covers the surgery, but not the lost income. Fortunately, she has an individual accident insurance policy that pays a $7,500 lump sum for fractures. Because she paid the premiums with after-tax dollars, the entire amount is received tax-free. She uses it to cover her monthly bills, avoiding the need to withdraw from her IRA or take on high-interest debt. The financial disruption is minimized, and her long-term savings remain intact.

Now consider the Johnson family, with two young children and a dual-income household. Both parents have employer-provided accident coverage, but the limits are modest—$2,500 per incident. When their son suffers a concussion during a soccer game and requires multiple specialist visits and cognitive therapy, out-of-pocket costs quickly exceed $4,000. Their supplemental individual accident policy pays an additional $5,000, which covers all co-pays and transportation to appointments. Again, because the policy was self-purchased with after-tax premiums, the benefit is tax-free. Without this layer, the family would have faced a difficult choice: delay treatment or strain their budget. Instead, they maintain both health and financial stability.

Another example involves Mark, a small business owner who spends long hours driving to client sites. After a minor collision, he suffers whiplash and is advised to rest for three weeks. His business income drops sharply during this period. His accident policy includes a daily hospital benefit and a payment for soft tissue injuries. He receives $300 per day for each day hospitalized (even if only for observation) plus a $4,000 lump sum. These funds help cover his fixed business expenses—rent, software subscriptions, insurance premiums—without dipping into his business line of credit. The tax-free nature of the payout means he doesn’t have to report additional income, keeping his annual tax filing unchanged.

These scenarios illustrate a consistent pattern: accident insurance works best when it’s part of a thoughtful, tax-aware strategy. It’s not about hoping for a payout—it’s about being prepared so that when life throws a curveball, the financial impact is manageable. The combination of immediate liquidity, flexible use, and tax efficiency creates a powerful advantage that few other financial tools can match.

Common Mistakes That Undermine Value

Despite its potential, many people fail to get the most out of accident insurance due to common oversights. One of the most frequent errors is underinsuring. Some choose the lowest premium option without considering whether the benefit amount would actually cover real-world expenses. A $1,000 payout may seem useful on paper, but it won’t go far when facing hospital bills, lost wages, and home modifications after a serious injury. Underinsurance creates a false sense of security—people think they’re protected when they’re not.

Another mistake is misunderstanding policy terms. Not all accidents are covered equally. Some policies exclude pre-existing conditions, high-risk activities, or injuries sustained while intoxicated. Others define “accident” narrowly, excluding conditions like repetitive strain or degenerative issues even if triggered by a specific event. Failing to read the fine print can lead to denied claims when they’re needed most. It’s essential to review definitions, exclusions, and waiting periods carefully before committing to a plan.

Many also neglect to coordinate coverage. They assume their employer’s plan is enough and don’t realize how limited it may be. Group policies often have lower caps, less flexibility, and may terminate if employment ends. Without a personal policy, individuals lose protection during job transitions. Additionally, some fail to update coverage as life changes—marriage, children, higher income, or new health concerns all affect risk exposure. A policy that made sense ten years ago may no longer align with current needs.

Finally, poor record-keeping can undermine even the best plan. When an accident occurs, submitting a claim quickly and accurately is critical. Missing documentation, unclear medical records, or lack of policy details can delay or reduce payouts. Keeping a digital and physical file with policy numbers, contact information, and a summary of benefits ensures a smoother process during stressful times. Avoiding these mistakes requires diligence, but the payoff is a reliable, effective safety net.

Practical Steps to Optimize Your Plan

Turning insight into action starts with a clear evaluation of current coverage. Begin by gathering all insurance documents—employer-provided and personal—and listing the benefits, limits, and conditions for each. Identify gaps: Are there scenarios not covered? Would a serious injury leave you financially exposed? Next, assess your risk profile. Consider your health, occupation, lifestyle, and financial responsibilities. If you’re the primary earner or have dependents, the need for robust protection is greater.

When selecting a policy, prioritize those that offer tax-free benefits, broad accident definitions, and fast claims processing. Look for features like lump-sum payments for specific injuries, daily hospital indemnity, and coverage for rehabilitation and transportation. Avoid policies with excessive exclusions or complex claim procedures. Work with a licensed insurance professional who understands both risk protection and tax implications. They can help compare options and recommend a plan that aligns with your goals.

Once a policy is in place, integrate it into your overall financial plan. Include it in your emergency fund strategy, coordinate it with disability and health insurance, and document all details in a secure location. Review the policy annually or after major life events to ensure it remains adequate. Pay premiums consistently and on time to maintain coverage. Over time, this disciplined approach transforms accident insurance from a passive expense into an active part of financial resilience.

Looking Ahead: Long-Term Benefits of a Smart Strategy

A well-structured accident insurance plan delivers value far beyond the moment of a claim. It strengthens overall financial health by reducing uncertainty, preserving capital, and improving cash flow predictability. When unexpected events occur, having a tax-free, accessible source of funds prevents the need to make reactive, high-cost decisions—like withdrawing from retirement accounts or accumulating credit card debt. Over time, this discipline compounds, allowing individuals to stay on track with long-term goals like homeownership, education funding, or retirement planning.

Moreover, the confidence that comes from being prepared cannot be measured in dollars alone. Knowing that a financial cushion exists—one that won’t trigger tax consequences—brings peace of mind. It allows individuals to focus on recovery, not financial survival. For families, it means protecting children’s stability during difficult times. For entrepreneurs, it means safeguarding business continuity. This sense of control fosters better decision-making across all areas of finance.

As life evolves, so should financial strategies. Accident insurance, when thoughtfully integrated, becomes more than protection—it becomes a foundation for lasting security. Small, consistent choices today—evaluating coverage, understanding tax benefits, avoiding common pitfalls—create lasting peace of mind tomorrow. In a world full of uncertainties, that’s a benefit worth planning for.